The Abu Dhabi Investment Council Company owns FAB, First Abu Dhabi Bank. Its main head office is in Dubai, the biggest bank in the United Arab Emirates. FAB is one of the largest, most secure, and trusted financial institutions recognized globally. FAB bank balance check service provides a wide range of services to customers, financial products and services, economic solutions, and other balance needs.

With operations on five continents, FAB demonstrates its ability to help people and businesses worldwide with its financial expertise. FAB is committed to delivering reliable and stress-free solutions, thus it continuously develops its products and services.

In this article, we’ll guide you about checking your FAB bank balance online, allowing you to do it effortlessly and comfortably from home. You may check your Rabiti card salary using the same procedure because your FAB bank account is also connected to your Rabiti Card.

3- Easy Ways to check FAB balance check online:

Table of Contents

If you carry an FAB prepaid card, you can easily check your FAB balance regularly. Hold your phone in your hands and follow these 3 easy steps.

- Go to the FAB’s web portal and select the relevant page.

- Next, Add your FAB prepaid two-digit card number.

- Enter your 13-digit card ID in the second box and click the “GO” button.

- After adding all the required information within a few seconds FAB bank balance will show on the screen.

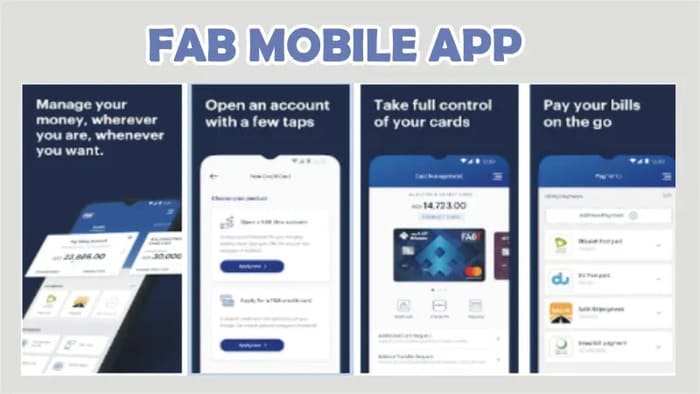

Which mobile application is best to check FAB balance check:

Nowadays, FAB account users prefer to check their bank balances online using their mobile devices as it is the easiest method. Additionally, the ATMs may not be close to your residence or workplace. The FAB app is the most convenient option for FAB account holders they can use it to inquire about transactions, balance, or salary status checks anytime.

- Install the FAB official mobile app from the Google Play Store.

- Once the app is installed, you will sign in or create a new account.

- After login, enter the account ID to FAB bank balance and check all the information shown on the home screen.

Quick process to check FAB bank balance

-

Ratibi (Salary) Prepaid Card:

For Ratibi prepaid card activation is not required. You may not need a Bank account or a minimum balance. 24 hours and 7 days customer service are available. ‘PINs’ for each cardholder can be reset at ATMs and free personal injury protection insurance.

-

ATM – FAB bank balance check

Checking your FAB balance through ATM is easier than ever and 100% hassle-free. Customers have multiple quick methods to check the balance of their accounts. Account holders can immediately check their balance at any nearby FAB ATM location using FAB ATM Balance Check. In an emergency, a Balance check from an ATM is not a reliable alternative instead, utilize an FAB machine nearby.

- Insert your ATM card into the machine.

- Enter your PIN code number.

- Select relevant options on the screen including checking your balance or withdrawing money.

The process is the same for ADCB branches in Dubai.

FAB bank balance check service also offers the following other prepaid card options:

- E-dirham card

- Payment Prepaid Card

- DWallet

- Prepaid Gift Card

- New Generation eDirham Cards

- Multi-Currency Prepaid Card

- G2 Al Haslah Cards

FAB WPS and Non-WPS Salary Payment Systems:

Wages Protection System is the slang term of WPS. The wage protection system, controlled by UAE rules, is funded by FAB Bank. WPS is a secure and beneficial system for paying salaries. Salary payments from FAB Bank are paid in AED, the local currency. The WPS service is automated.

FAB Bank also aids non-WPS salary payments. FAB bank provides rabi cards for non-WPS salary payments if the employer has a corporate bank account. The employee must live in the UAE to receive a non-WPS wage.

How expatriates can open FAB bank account in UAE:

If you’re a new expatriate in UAE, you can only open a savings account. Dubai restricts banks from opening current accounts. Nonresidents will not receive checkbooks they receive debit cards to use deposit funds and withdraw from ATMs.

If you wish to register yourself for an FAB bank account as a non-citizen status for a specific purpose of personal account or business. Non-citizens in the UAE need the following necessary documents to open a personal bank account:

- A copy of your passport showing the entrance page for the UAE.

- Current curriculum vitae.

- An original copy of a letter of recommendation from your bank, whether in your home country or any other country, where you have a personal or business account.

- An original copy of your bank statements of the previous six months, from your home country or anywhere else.

Want to know How to make money in Dubai?

FAB Prepaid Cardholders Multiple Benefits:

FAB Prepaid Cardholders can enjoy multiple benefits. We will assist you by including a complete list of all the benefits below:

- There is no minimum balance requirement for cardholders.

- Free insurance access is available.

- To access a wide network of ATMs and CDM

- Use the international VISA/MasterCard networks to obtain the benefits without having a bank account.

- The call center is open 24/7 and provides customer support.

- Complete adherence to the WPS guidelines established by the UAE government Free SMS Alerts

- Reduce the risk of carrying cash

- A bank account is not required.

- A secure way to get your money

- Automatically salary crediting

FAB Cashback Offers Monthly basis:

FAB Bank offers the best way to save money through its cashback program. Through this program, you could receive cash back on your regular purchases.

Use your FAB debit or credit card for all purchases to take advantage of this service, and deposit your pay there. You’ll then get a statement indicating how much cashback you’ve earned at the end of each month.

Foreigners and UAE citizens, however, have different cashback limit amounts. The UAE authorities restrict residents to AED 5,000 per month, while they restrict foreigners to AED 2,500 per month.

UAE Residents:

Earn 3% cashback if your salary is between AED 5,000 and AED 25,000. The price will range from 150 to 750 AED.

You will receive 4% cashback if your salary is between AED 25,000 and AED 50,000. It will cost in the range of 1,000 and 2,000 AED.

You will receive 10% cashback if your salary is above 50,000 AED. This will not exceed 5000 AED.

Do you know How to renew driving license in Dubai?

For Expatriates:

Earn 2.5% cashback if your salary is between AED 5,000 and AED 25,000. The price will range from 125 to 625 AED.

You will receive 3% cashback if your salary is between AED 25,000 and AED 50,000. It will cost in the range of 750 and 1500 AED.

You will receive 5% cashback if your annual salary exceeds 50,000 AED. The maximum number will be 2500.

Final Words:

FAB customers can use 24/7 banking services like checking balances and sending and receiving payments from FAB bank balance checks digitally. Financial security, international banking exposure, 24/7 client service, and fair loan offers are just a few of the excellent banking advantages of FAB.